In the recent Inflation Reduction bill, there was a rider that gave 80 billion dollars to the IRS for hiring 87,000 more IRS agents. This is almost ten times the current agent staff, and is designed to help collect what they hope to be billions of dollars in money from low to average income earning people. This is a puzzling development at best, as the amount of money to be collected is peanuts compared to the average revenue adjustment that the agents call for, which I’ll get into later.

In the recent Inflation Reduction bill, there was a rider that gave 80 billion dollars to the IRS for hiring 87,000 more IRS agents. This is almost ten times the current agent staff, and is designed to help collect what they hope to be billions of dollars in money from low to average income earning people. This is a puzzling development at best, as the amount of money to be collected is peanuts compared to the average revenue adjustment that the agents call for, which I’ll get into later.

First, remember that the average taxpayer can’t afford to hire a person who is a Certified Public Accountant (CPA) as those who are well off can do. So people will have to be doubly aware about the new regulations, particularly with regard to transactions that involve Internet payments such as PayPal and Venmo. They must insure to keep all their W2’s and employer’s Tax I.D. While it is relatively simple then go to a business accounting office to deal with the IRS, at this time most IRS agents are reasonable people like you and me, and know that honest mistakes can be made, but it is still important to remember that they are their to collect money, not to be amiable.

Make sure you keep all your appointments and bring all the paper work that they ask. Your accounting associate should go with you and work it out it’s pretty simple. Mostly, don’t act rough and tough for you will surely lose your case. I myself was once audited by the IRS, so my approach was straightforward. I brought in all the documents they needed. I did win my case, but I did have to pay for one year.

Now for the startling news. Along with hiring new agents, the IRS will be expanding their reach to whom they will audit, as well as tailor those audits to some people based upon their social exposure on the Internet, voting registers, and their voting donation history on Open Secrets. If you give to progressive and Democrats, for the most part you should be ok, but if you have given to Trump or other candidates on the right of the political spectrum, expect to get at least one or even two audit requests per year. Just make sure you keep all your records, though, and you should be fine.

Today, the DOJ gave the FBI a search warrant to search former President Donald Trump’s residence Mar a Lago in Florida. They brought approximately 30 federal agents in 18 vehicles. Original reports were that they have kicked Trump attorney Christina Bobb out of the house, and actually restricted her presence at the end of the driveway in 90 degree heat. In addition, they did not give her a warrant or court authorization, instead flashing it at her from a distance of about ten feet, where she could not read the contents. The agents reportedly spent over nine and a half hours searching the residence, finally emerging with an estimated 15 boxes of documents.

Today, the DOJ gave the FBI a search warrant to search former President Donald Trump’s residence Mar a Lago in Florida. They brought approximately 30 federal agents in 18 vehicles. Original reports were that they have kicked Trump attorney Christina Bobb out of the house, and actually restricted her presence at the end of the driveway in 90 degree heat. In addition, they did not give her a warrant or court authorization, instead flashing it at her from a distance of about ten feet, where she could not read the contents. The agents reportedly spent over nine and a half hours searching the residence, finally emerging with an estimated 15 boxes of documents. Former President Donald Trump is letting America know about how immigration is ruining our country. He is just exposing how the Biden administration is out of control when our president is just helpless in running our country. Millions of illegal immigrants are flooding into the country, many who are carrying millions of dollars of illegal drugs that have killed over 100,000 Americans. In addition, a third of all women and female children coming into our country are sexually abused, and the overall death rate is overwhelming. With the midterm elections coming, Republican governors from Florida, Texas, and Arizona are busing the illegal aliens to New York and Washington D.C., creating problems for their respective mayors and housing authorities.

Former President Donald Trump is letting America know about how immigration is ruining our country. He is just exposing how the Biden administration is out of control when our president is just helpless in running our country. Millions of illegal immigrants are flooding into the country, many who are carrying millions of dollars of illegal drugs that have killed over 100,000 Americans. In addition, a third of all women and female children coming into our country are sexually abused, and the overall death rate is overwhelming. With the midterm elections coming, Republican governors from Florida, Texas, and Arizona are busing the illegal aliens to New York and Washington D.C., creating problems for their respective mayors and housing authorities.

During China’s 4-day exercise of live fire drills, the military fired missiles which flew over Taiwan and landed in the waters around Taiwan. Xi Jinping is crying just like a spoiled baby who wants the toy which was put up so the baby could eat at the high chair. Why does China cry about Taiwan? Remember, the official name of the country of Taiwan is the Republic of China, which originally was the place were the original mainland China’s government fled to during the Chinese communist revolution.

During China’s 4-day exercise of live fire drills, the military fired missiles which flew over Taiwan and landed in the waters around Taiwan. Xi Jinping is crying just like a spoiled baby who wants the toy which was put up so the baby could eat at the high chair. Why does China cry about Taiwan? Remember, the official name of the country of Taiwan is the Republic of China, which originally was the place were the original mainland China’s government fled to during the Chinese communist revolution. Right now China is conducting live fire drills around Taiwan and Xi Jinping hasn’t said when he plans to stop the blockade. China under control by Xi Jinping blockade because Speaker of the house vists Taiwan who has a democratic leadership something like the United States. Xi Jinping has lost face because he failed to understand how our democracy works, we Americans don’t take kindly to being thought of as weak and can be scared by a weak China. But Xi Jinping was called out and he looks very weak in front of the Communists party and all his saber rattling won’t make Nancy Pelosi to back down. Now all American woman should be proud of our speaker who understands China. China will only beat up on weak people and weak countries. I have to admit this story is exciting and we get to actually watch and see the sweat on Ji Jinping’s face as he sweats his possible life away. Communists don’t like their leader to look weak.

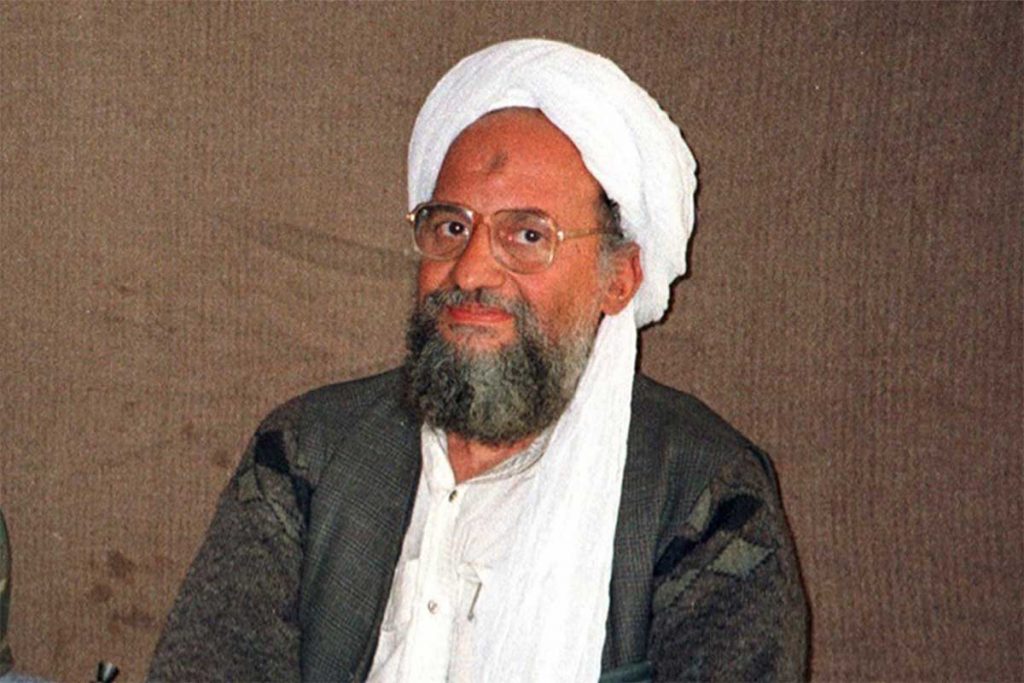

Right now China is conducting live fire drills around Taiwan and Xi Jinping hasn’t said when he plans to stop the blockade. China under control by Xi Jinping blockade because Speaker of the house vists Taiwan who has a democratic leadership something like the United States. Xi Jinping has lost face because he failed to understand how our democracy works, we Americans don’t take kindly to being thought of as weak and can be scared by a weak China. But Xi Jinping was called out and he looks very weak in front of the Communists party and all his saber rattling won’t make Nancy Pelosi to back down. Now all American woman should be proud of our speaker who understands China. China will only beat up on weak people and weak countries. I have to admit this story is exciting and we get to actually watch and see the sweat on Ji Jinping’s face as he sweats his possible life away. Communists don’t like their leader to look weak. The United States will be talking about the killing of Al Qaeda leader Ayman al Zawahiri. He was Osama bin Laden’s primary lieutenant when he, along with other conspirators, planned the September 11, 2001 terrorist attack that killed almost 3,000 Americans when the Twin Towers and the Pentagon were hit by hijacked jets. That was a very sad day for America but with resolve we continued the war on terror.

The United States will be talking about the killing of Al Qaeda leader Ayman al Zawahiri. He was Osama bin Laden’s primary lieutenant when he, along with other conspirators, planned the September 11, 2001 terrorist attack that killed almost 3,000 Americans when the Twin Towers and the Pentagon were hit by hijacked jets. That was a very sad day for America but with resolve we continued the war on terror. Today, Ukraine is in more trouble than anticipated as the money we are sending has been unaccounted for. The weapons that were supposed to be earmarked for the Ukraine army. There is even some speculation that the weapons which we have sent don’t even seem to be of any use, as the Russians are shoring up what they have captured. At this point, basically 20% of Ukraine is under the control of Russian forces. When the conflict started, Russia was vastly underestimated in both its technical capabilities and its staying power, and there is no good reason why our own military and experts have been so far off the mark.

Today, Ukraine is in more trouble than anticipated as the money we are sending has been unaccounted for. The weapons that were supposed to be earmarked for the Ukraine army. There is even some speculation that the weapons which we have sent don’t even seem to be of any use, as the Russians are shoring up what they have captured. At this point, basically 20% of Ukraine is under the control of Russian forces. When the conflict started, Russia was vastly underestimated in both its technical capabilities and its staying power, and there is no good reason why our own military and experts have been so far off the mark. The United States is having so much negative growth and jobs will be cutting by the thousands as our President Biden is compromised by his son, Hunter. The main question is whether Biden being blackmailed by China or Russia. If so, what can the United States do since our president is in so much trouble with everything? I can, and have, written pages and pages on why we need new leaders in the White House.

The United States is having so much negative growth and jobs will be cutting by the thousands as our President Biden is compromised by his son, Hunter. The main question is whether Biden being blackmailed by China or Russia. If so, what can the United States do since our president is in so much trouble with everything? I can, and have, written pages and pages on why we need new leaders in the White House. White House is receiving threats from Chinese leader Xi Jinping. It has been reported that China doesn’t want Speaker Nancy Pelosi to visit Taiwan and some of the threats seem to be they will shoot missiles at the plane she is flying in. Some of the other threats go as far as it has been reported China will shoot down her plane.

White House is receiving threats from Chinese leader Xi Jinping. It has been reported that China doesn’t want Speaker Nancy Pelosi to visit Taiwan and some of the threats seem to be they will shoot missiles at the plane she is flying in. Some of the other threats go as far as it has been reported China will shoot down her plane.